Yes, a $4000 budget for a 2,600-square-foot house!! While the average cost to furnish a house ranges between $10,000 to $40,000 for a 3-bedroom, our budget may sound crazy. However, we managed to do it by staying true to our authenticity and pursuing a prudent lifestyle. Here is how we do it.

1. Buy an old house:

The main advantage of an old house is that we will inherit many costly appliances from the previous owners. In the United States, homeowners typically leave attached appliances and room furnishing to the new owners when they sell their houses. In our cases, we saved a bunch of costs for the items below:

- Washer

- Dryer

- Dishwasher

- Stoves and microwave

- Curtains and blinds

- Lights and chandeliers

- Ceiling fans

If we bought a new house, we would have to chip in at least $7,000 for the items above. However, I would recommend a moderately old house where all the appliances are fairly up-to-date rather than an ancient house with antique appliances. This will save us a bunch of cash flow in energy bills. In our region, a house aged less than 20 years old would be a decent buy.

2. Prioritize secondhand furniture:

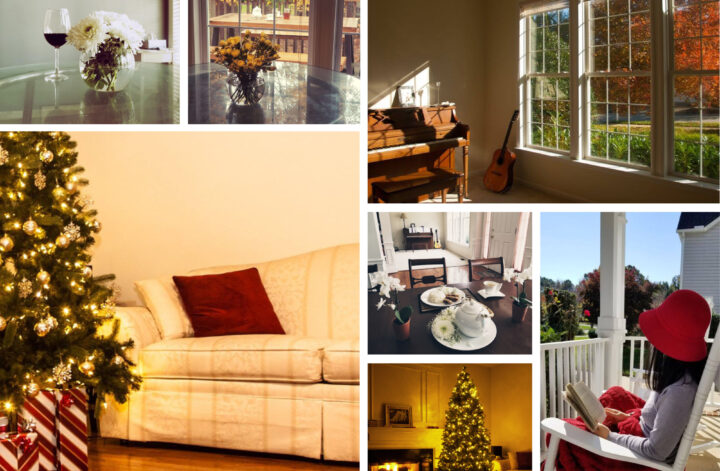

This is the key to lowering the cost to furnish a house. We found most of our furniture from Craigslist and local stores. For in-home furniture, we can buy higher quality and more durable items at significantly lower prices than brand-new ones. Finding decent-quality secondhand goods may be more difficult for outdoor living spaces. Hence, we searched for good deals on sale. It may take time to wait for the right deals, but we had no rush to furnish the outdoor area. We could live perfectly happily in our house with an empty deck and an empty porch before finding the good deals to buy. Here is the list of our purchases:

- 2 wooden bedframes with mattresses: $1,100

- Dining table with 6 chairs: $200

- Kitchen table with 2 chairs: $20

- Sofa sets with area rug and 2 side tables: $500

- 2 front porch rocking chairs: $150

- Table set at the backyard deck: $300

- Piano: $400

The downside of buying secondhand furniture is the time we spend searching for compatible pieces from multiple vendors. For example, it took us over 1 month to find a decent piano below the $500 budget. I would not go for this low budget if I hadn’t played piano for over 10 years and had quite sensitive ears for sound quality. The same principle goes for other purchases, it takes years of developing a taste for fine quality to become an effective secondhand buyer.

3. Gifts, vouchers and presents:

My husband and I have years of following a low-waste lifestyle before we bought our first house at the age of 31. We used to share apartments with our friends since we were students. When our co-renters relocated, they typically left their belongings. We, on the other hand, welcome all these inheritances and never leave anything behind.

Years of living in rental apartments also gave us decent time to practice limiting our unnecessary purchases. Therefore, when we bought our first house, we weren’t overwhelmed with the temptation to go overboard with accumulating belongings for the new home. Moreover, with the quality relationships we built over time, we knew our house would quickly be full of presents and gifts. Limiting our decorative items also saves us time decluttering in the foreseeable future.

Some of the presents and gifts are as below.:

- Kitchenware: this is the most common left behind when our friends relocate.

- Embroidery paintings: these are presents from my dear mother-in-law. She embraided all the authentic paintings in our home.

- Office room furniture: while study desks and bookshelves are must-haves for all students, they usually don’t bring these items when relocating to other regions.

- All 4 lamps in the house: we bought them with a voucher gift from our real estate agent

- All decorative items: these are presents from our dear friends and neighbors.

We are fortunate to meet affectionate people from all walks of life. No matter how long we share memorable times, seeing their souvenirs in our homes warms our hearts. On the journey to become a wise consumer, I always remind myself to make room and space for the next gifts to present in our house. This also means making room for the next person to leave a memorable gift in my heart.

4. Define a home style that suits your style:

Our 1st house is a typical cookie-cutter style home. It looks like just any other house in the neighborhood area. This saved us tons of time to find compatible furniture in local markets, not to mention delivery costs. We don’t customize since this won’t be necessary for a cookie-cutter home.

Buying a new house, especially the first home, is a big milestone in anyone’s life. As elaborated in a previous post, it’s not easy to resist the temptation to buy tons of furniture. I always remind myself that this is not our only home and we will keep buying more dream homes if we keep our cost to furnish a house within budget. With the power of compound interest, a dollar saved today will bring the opportunity to buy more dream houses. Since we stick with our home for a long time, what matters the most is the long-term comfort and happiness of our daily life, in which a healthy budget and good financial well-being are crucial.